Future-facing Retail

The data gathered using facial recognition is invaluable to traditional retailers with bricks and mortar stores; it is finally levelling the playing field between the data-gathering-led online retail giants and those still operating traditional retail locations. And as traditional retailers search for a formula that can help them survive in a digital future, a new online/offline hybridity is emerging

Imagine walking up to the cashier at a department store and, without presenting a credit card or handing over cash, simply flashing a smile by way of payment. It sounds absurd, but soon, you may find yourself doing just that. Ant Financial, part of online shopping giant Alibaba, is introducing a system that uses facial recognition to identify customers and lets them pay simply by smiling at a 3D camera. The system is already being rolled out; it’s now available for diners at KFC in parts of China. This technology is one example of the growing use of facial recognition by retailers.

There are two main benefits for retailers using facial recognition technology; firstly, it allows security cameras to automatically spot known shoplifters and alert the staff. However, the application of facial recognition that promises to have the most profound impact is the ability to track the activity and habits of every individual customer. Here’s a scenario; you enter a store for the first time, a camera sees your face and creates a new customer profile on a server. The shop’s in-store WiFi picks up the presence of your phone and matches your profile to your online identity. Cameras track what items you look at in the shop and which parts of the store you linger in. When you go to the cashier and hand over your credit card, your profile is matched to a name, spending history, demographic details and so on. And then, the next time you go online, you’re served personalised adverts based on what you looked at in the shop. The next time you walk into a shop connected to the same network, precision-targeted in-store promotions pop up on your phone screen and the cashier greets you by name.

This scenario relies on existing technology. While very few retailers are prepared to be forthright about the extent to which the above scenario happens in real life, a 2015 survey of British retailers showed that one in four UK shops use some form of facial recognition technology. And that figure is higher on some sectors than in other; 59% of UK fashion retailers now use facial recognition on their customers. The application of this kind of data gathering is changing the way we shop. But it is part of a process that has been going on for decades.

|

BIG DATA TECHNOLOGY: Long before online shopping became widespread, retailers with bricks and mortar stores used digital technology to maximise their profitability and to improve the experience of their customers. Over the past twenty years, those same retailers have raced to compete with a new generation of giant online marketplaces such as Amazon, eBay and Taobao. It was often a losing battle, fought on the online retailers’ high-tech home turf. However, this competition for market share may be reaching equilibrium. And in the process, a new hybrid form of shopping is being designed that blends the best elements of the online and offline worlds. A hybrid of up-to-date technology and traditional marketing knowhow. It is an indicator of how far we have become acclimatised to the sharing of our personal data, that back in the 1990s, supermarket loyalty cards were viewed with a level of suspicion that now looks quaint. Back then, the term big data had only just been coined, and the technology that makes big data possible was in its infancy. However, retailers were already realising the power of collecting information on consumers. By tracking a customer’s shopping habits, it was possible to more efficiently target adverts and to design in-store visual merchandising that would persuade individual customers to spend more money. The payoff from the point of view of the customer was receiving special offers earned by spending money in-store. This was a driving force in the development of, now ubiquitous, networking technologies. However, the idea that retailers were tracking the habits of their customers generated a surprising amount of anxiety, which was openly expressed in the media of the time. Since launching in 1994, Amazon has expanded from a specialist online book retailer to become the world’s biggest retailer by total sales and market capitalisation, selling just about every product imaginable and flirting with everything from manufacturing their own electronic goods to launching experimental drone delivery services. In response, traditional retailers clamoured to launch their own online services and struggled to compete with the online giants. Even in the early days, those giant online retailers had already learned a lot from watching the bricks and mortar shops’ experiments with big data. We’re all familiar with pop-up ads telling us that “Customers who bought this product may also be interested in…” we’ve all browsed online for a particular product only to find every web page we look at afterwards swamped with adverts for that same product. Those are just the most straightforward manifestations of personal data being leveraged in order to target individual consumers and the most visible face of the technology that has been devised to manipulate and exploit that data. Shoppers, however, have not become entirely inured their personal data being shared, and this concern is still a factor that holds back the digital retail industry. Indeed, it is a barrier that is hard to overcome with technology alone. However, the scale of online retail gives an indication of just how much data is gathered by the likes of Amazon and Taobao; this year, online retailers had a little over 10% share of global retail sales, their share is up from 7.4% just two years ago and is due to increase by half again by 2021.

|

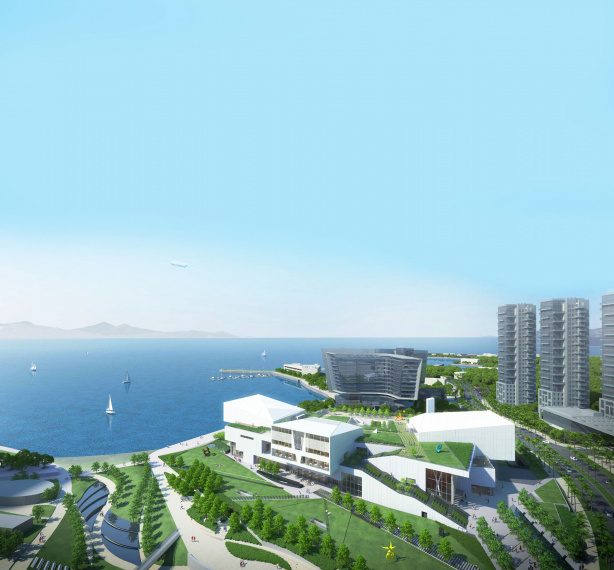

BACK TO BRICKS AND MORTAR: Clearly, online retail is far from reaching market saturation. Nevertheless, there is an increasing trend of online retailers, from the aforementioned retail giants down to sole-traders selling handicrafts, aiming to improve their turnover by, if not entirely eschewing the high-tech approach, at least combining it with investment in a real-world presence. The primary reason for this is simple; as one such retailer explained to Signed, “Real world presence creates a degree of visibility that generates sales later online.” Investment in this kind of pop-up presence presents a financial risk to a retailer of any size, but it is becoming an increasingly necessary risk if retailers are to stand out from the crowd - there is no more crowded marketplace than the internet. An added positive of such pop-up stores, is that shopping districts that were threatened with being eviscerated by competition from online retailers are being given a new lease of life by this vibrant new retail trend. That online retailers are recognising the value of real world presence underscores the importance of designing a shopping experience that amounts to more than just browsing and purchasing. And this is an area where traditional retailers have the upper hand thanks to centuries of experience designing shopping experiences. This goes far beyond simple visual merchandising, involving architecture and systems design. In London, Burberry’s flagship store on regent Street and Ralph Lauren’s New York Fifth Avenue store both now feature coffee shops, Hackett’s London store even features a gin bar. Hackett’s Managing Director, Vicente Castellano has described this as “A great incentive to increase browsing time and ultimately increase sales.” However, not all retailers have such short-term views on the matter, George Graham, co-founder of designer boutique Wolf & Badger, has claimed that “For us, it’s really about driving more footfall and more regular visitors to the store.” For retailers who have invested in real-world presence, visibility is key, and from visibility sales will follow, online or off. |

|

BUCKING THE TREND

In order to design a retail experience that encourages the maximum number of shoppers to part with their money, it is important to know what affects people’s decisions on where they shop. Technology can help here, but technology alone is useless without a well designed strategy for its implementation. Luckily, there is a solid body of research to inform this design process - much of which can help retailers deal with challenges unique to Hong Kong’s shoppers.

A 2017 study by Hong Kong Trade and Development Council revealed that 51% of Americans prefer to shop online, while the mainland Chinese population has embraced online life with Chinese survey respondents shopping online an average of 63 times a year, or 5.25 times a month, a huge increase on the 1.43 times a month reported when the same survey was previously carried out in 2013. However, Hong Kong seems to be bucking the trend.

According to the Hong Kong Government’s Census and Statistics Department only 23% of Hongkongers shop online, compared to 81% in the UK, 78% in the US, 73% in Germany and 67% in Chinese Mainland. Furthermore, of those 23% of Hongkongers who shop online, online spending represents only 4% of their overall non-housing spending.

Concerns over data security remain the biggest barrier to the adoption of online retail in Hong Kong. When we approached them for comment, one Hong Kong based online fashion retailer reported, anecdotally, that over and above concerns about fakes or product returns, their customers expressed a distrust of online payment services such as PayPal. Despite PayPal being viewed as the industry standard internationally, in Hong Kong it seems to lack the popular recognition that it has overseas. While there are many other payment platforms available, the difficulty in persuading Hong Kong’s shoppers to use payment methods that are standard in other countries stymies the attempts of overseas retailers wishing to expand in the territory. Meanwhile, 29% of Hongkongers who don’t shop online said they would consider doing so if more payment options were available. Moreover, 30% of Hongkongers questioned cited data security as their main problem with shopping online, while a much smaller number of those questioned (22%) were more concerned about product quality and accidentally buying fake goods.

This data, based on well-conducted studies by reputable organisations, is invaluable to Hong Kong’s online retailers if they wish to use technology to design new shopping experiences. Those retailers have responded, like their international counterparts, by turning to real-world, on-street presence to boost their fortunes. However, where for international brands, improved visibility is the primary motivation for setting up bricks and mortar stores, for Hong Kong brands the reasons are led by research on local conditions; only 13% of Hongkongers cite not knowing which websites to use as a reason for not shopping online, and only 9% of consumers claim to find bricks and mortar stores more convenient than shopping online.

HYBRIDITY

The result of all of the above has been a new form of online/offline hybrid retail experience emerging in Hong Kong, designed to cater to the particular peccadilloes of the city’s market. A prime example is Hong Kong-based clothing retailer Grana. Grana is primarily an online business, taking advantage of the ease of selling overseas and the low overheads that come from operating online. The company makes the most of Hong Kong’s position as an international shipping hub to minimise the cost of importing materials and to maximise the ease of delivering goods to the US, Europe and the rest of Asia. However, the brand also operates a ‘fitting room’, an (almost) conventional shopfront where shoppers may try on clothes, chat with staff and get a feel for the brand. This all serves to overcome the specific concerns that evidently hamper online retail in Hong Kong - the ‘fitting room’ will even take returns from customers dissatisfied with their online purchase. The difference between the ‘fitting room’ and a conventional shop becomes apparent as soon as a customer wishes to make a purchase. At this point, the customer is led to a computer screen, where they must set up an account before completing the transaction online and arranging for their purchases to be delivered.

To see shoppers leaving Grana’s ‘fitting room’ empty-handed, to go home and await the delivery of their new clothes, is a strange upending of the notion that online is more convenient than shopping in real life. However, the whole experience builds trust between retailer and consumer while also allowing the customer’s data to be gathered. And as the buyer has to set up an account in the process, it is likely to lead to return custom.

|

PRIVACY CONCERNS In the age of instant online availability of almost any item we could wish to shop for, it is more important than ever to design an experience that will aid the shopper in navigating the myriad choices on offer. Technology can help in matching consumers to whichever item they want to buy (even if they don’t know they want it yet). It can help speed up transactions and improve customer service. But, these technologies are tools to be used wisely. With the adoption of facial recognition and other data gathering technologies, the same privacy concerns that hold back the growth of online shopping could easily begin to alienate the customers of traditional bricks and mortar stores. For example, a recent survey of shoppers in the UK found that 77% of respondents said they found the idea of a salesperson knowing their spending habits in advance, based on data gathered using facial recognition ‘creepy’. On the other hand, that same survey showed that many shoppers appreciate the potential benefits that this technology could bring, such as personalised special offers. Retailers must strike a delicate balance in using this technology effectively; there is no way that customers can opt out of being scanned by facial recognition cameras once they are installed in the shop, and the last thing retailers want is to discourage people from entering the store in the first place. Even with all the technology now available, it seems that the personal relationship between shopkeeper and consumer is something that cannot be easily replaced. |

Others

最新動態 | 1 March 2018

Exporting Shenzhen’s design culture

最新動態 | 1 March 2018

Shenzhen’s Shifting Fortunes

最新動態 | 1 March 2018

In Praise of Silk: Fashion from China National Silk Museum Across Time

最新動態 | 1 March 2018

KEEP WATCH-ING

最新動態 | 1 March 2018

Into the Laboratory

最新動態 | 1 March 2018

Different Paths

最新動態 | 1 March 2018

Are you working well?

最新動態 | 1 March 2018

Adventures in Space

最新動態 | 1 March 2018

The Chain